Chesapeake – where ‘It’s All About Community’

Chesapeake Bank’s roots stretch deep into the sandy soil of Virginia’s Northern Neck and reach back to the dawn of the twentieth century. Originally charted as Lancaster National Bank on April 13, 1900, we’ve been focused on our community from the very beginning. The bank’s first clients were watermen, farmers and small business owners.

Our only branch was in Irvington, a secluded steamboat port off the Rappahannock River. Those were the days before bridges – much less highways – linked the Northern Neck to urban centers. The bank played an essential role in the local economy, and we knew it. So, when the Great Irvington Fire of 1917 destroyed our offices, we set up shop in a tent. In 1933, the region was not only rocked by the Great Depression, but also by the worst storm in years. It wiped out the remaining steamboat wharves and many businesses. But we survived and helped our community rebuild.

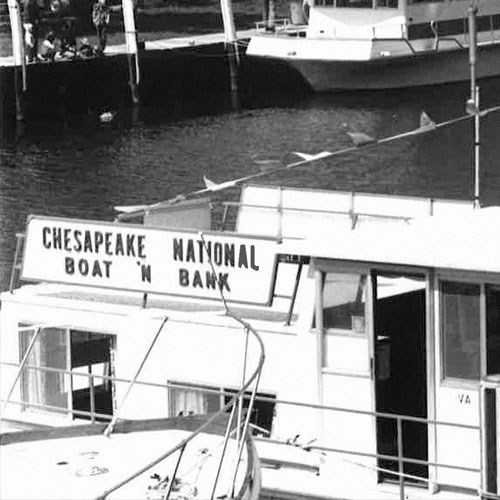

We grew along with the area as it emerged as a popular vacation and retirement location. We merged with Chesapeake Banking Co. of Lively in 1968 to become Chesapeake National Bank. Always responsive to local needs, we launched the nation’s first floating boat bank (as seen below) to better serve the workers at the oyster packing plant in Irvington and added the trust department, now part of Chesapeake Wealth Management, two years later.

We dropped the “National” from our name in 1994 and became Chesapeake Bank. Today the retail bank operates sixteen offices; four in the Northern Neck, three in the Middle Peninsula, five in Williamsburg and four in Richmond. And we’ve remained on the forefront of community banking while keeping our local flavor and commitment to personal, innovative service.

In 1995, we added our Flexent division to bring businesses the access they need to cash in order to thrive and grow. Flexent serves growing businesses across the country. They are a member of the International Factoring Association, and through the association with Chesapeake Bank, FDIC-insured. To learn more talk with their team of highly dedicated, highly experienced professionals.

Merchant Services, now know as Chesapeake Payment Systems, was added as an option for businesses in 1997. We started out processing credit and debit cards for businesses and providing equipment to growing into an online processor with robust reporting and a team of friendly high-qualified support specialists. And, now, as a direct agent with VISA and MasterCard, we sponsor Independent Processors with clients nationwide.

It was in April 1973 when Douglas Monroe, Jr., then CEO of Chesapeake Bank, asked Thomas Denegre, Jr., a trust officer at Virginia’s oldest bank, Burke & Herbert in Alexandria, to head up the Northern Neck's first full-service trust department. Today, Chesapeake Wealth Management offers a host of in-house investment, trust, and fiduciary services with more than $500 million in assets under management.

It’s programs like these and other banking initiatives that are the engines that have fueled our growth from the $25,000 we started within 1900 to over $1.2 billon in assets today.

In 2021 we were recognized for the fourteenth straight year by American Banker magazine as one of the "Top 200 Community Banks" in the country based on return on equity. To learn more about our financials, visit our Chesapeake Financial Shares website.