Market Commentary

Market Overview

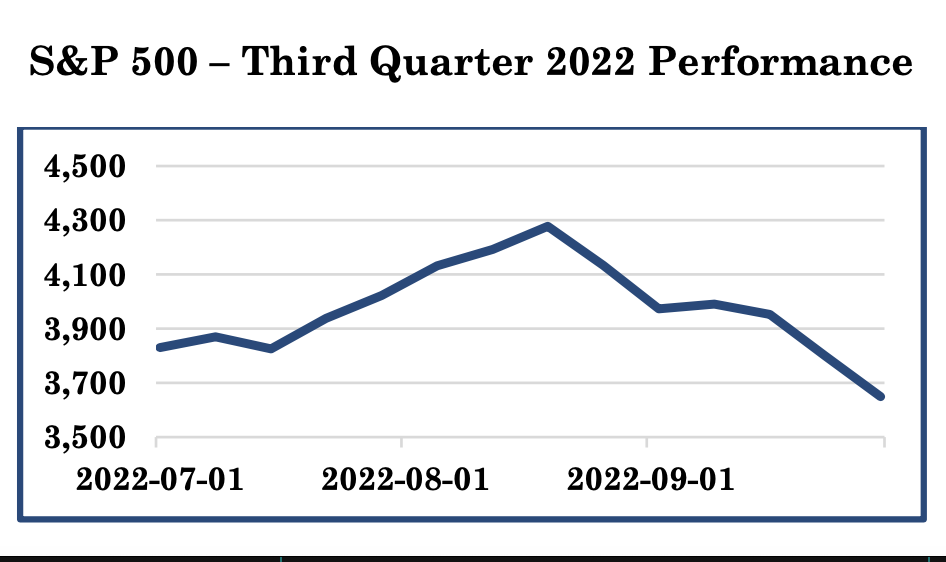

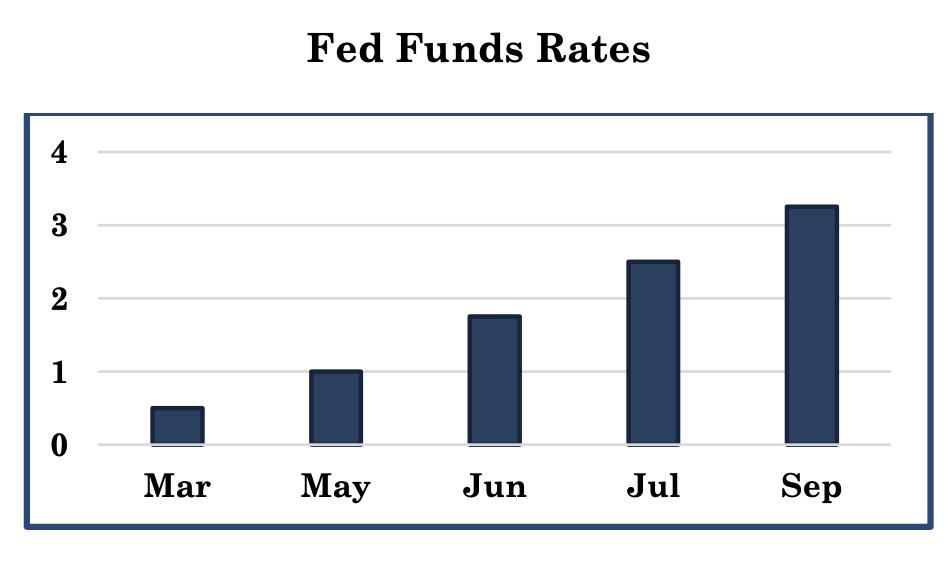

Global markets declined again in the third quarter as inflation remained near multi-decade highs, geopolitical tensions escalated further, and the Federal Reserve continued to aggressively hike interest rates signaling future rate increases. The quarter started with a rebound in stocks and bonds that was largely driven by corporate earnings and signs that inflation had possibly peaked which could signal an end to the rate hiking cycle.

On the earnings front, second quarter results were better than feared. Despite lingering inflation and supply-chain issues, the majority of earnings reports beat estimates. The earnings resilience showed investors that, despite numerous macro challenges, the economy appeared to remain in solid shape. On inflation, several reports showed price declines in June and offered hope that inflationary pressures were weakening. And, although the FOMC raised rates by 75 bps, Fed Chair Powell acknowledged that at some point in the future it would be necessary to slow the pace of rate increases. Investors interpreted those comments as a signal that the tightening cycle would wind down sooner than originally expected. Stocks moved higher in July and continued through the first half of August.

Momentum continued to move in a positive direction through early August with the idea of a Fed pivot to a less aggressive policy stance gained strength. Ultimately, the move higher proved to be a bear market rally following sobering remarks made by Fed Chair Powell at the Jackson Hole Economic Symposium. At the Symposium, Powell made it quite clear that there would be no pivot there were clear signs that inflation has been brought significantly lower. Powell also added that there was likely to be economic pain as a result of the continued rate hikes. The reiteration of aggressive policy combined with the potential for economic pain sent the market lower. The selling continued into September as the August CPI report showed a slight increase in prices, implying that while inflationary pressures may have peaked, no rapid decline was evident. Later in the month, the Fed raised rates an additional 75 bps.

Geopolitical concerns also pressured stocks in September as Russia escalated its war in Ukraine by holding referendums in occupied territory and by announcing general population mobilization efforts. As September was coming to a close, currency and bond markets were further sent into turmoil as the United Kingdom announced a spending package designed to stimulate its economy but would also ultimately add to inflation.

Performance

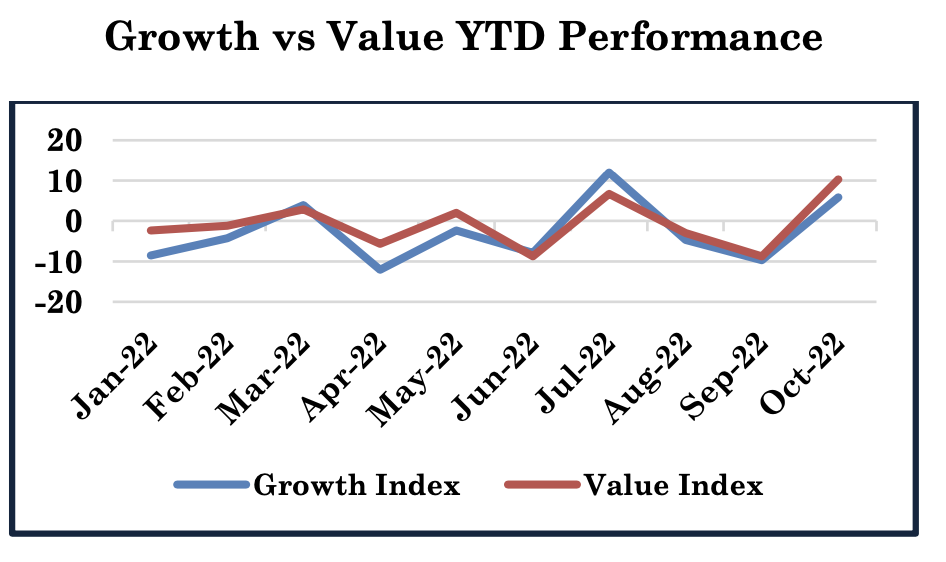

All four of the major U.S. stock indices posted negative returns for the third consecutive quarter. Unlike the first two quarters of 2022, the NASDAQ did not significantly lag the other indices. By market capitalization, small-cap stocks outperformed large-caps, though modestly. The small-cap outperformance came early in the quarter as hopes of a quick decline in inflation permeated the market. Those hopes faded in late August and through September as interest rates hit new highs and investors rotated toward the safety of large-cap stocks. From an investment style standpoint, both growth and value registered losses. Unlike the first half of the year, however, growth outperformed value on a relative basis. Similar to small-cap stocks, growth rallied early in the quarter on the belief that the economy had turned a corner on inflation and an anticipated rate cycle pivot. Also, like small-cap, growth stock outperformance shrank late in the quarter once it became clear the inflation down- tick would not materialize.

On a sector level, all but one of the 11 S&P 500 sectors finished the quarter with a negative return. Consumer Discretionary stocks posted a positive return thanks to stronger-than-expected consumer spending and still low unemployment. Meanwhile, the energy sector experienced solid earnings and strength in natural gas prices. Laggards during the quarter included communication services, real estate, and materials. Communications has simply fallen out of favor with investors along with technology while real estate has decline in the face of spiking mortgage rates and slowing home price appreciation. Materials lagged as a result of lower commodities prices, poor earnings from several chemical companies and the general belief that the global economy is slowing.

International

Internationally, foreign markets badly underperformed the U.S. domestic markets during the quarter. Reasons for this include surging electricity prices, interest rate increases made by the ECB and BoE, and the effects of the war in Ukraine. Emerging markets underperformed both U.S. and international developed markets based largely on a surging U.S. dollar.

Commodities

Commodities dropped sharply in the third quarter as a combination of a multi-decade high in the U.S. dollar, growing fears of a global recession, and sharply rising interest rates weighed on industrial commodities as well as precious metals. Crude oil prices also fell as concerns about future demand offset geopolitical worries. Gold, meanwhile logged negative returns largely due the surging dollar and fading market-based inflation expectations.

Fixed Income

In the world of fixed income, most bond indices posted negative numbers. Stubbornly elevated inflation, continued Fed rate hikes, and a late- quarter sell-off in global bonds led to most bond classes to end the quarter lower, extending year- to-date declines.

Short-term U.S. Treasury bills outperformed longer duration notes and bonds as the threat of greater than previously expected rate hikes by the Fed became a reality. Corporates outperformed longer duration government bonds on a relative basis during the quarter thanks largely to solid U.S. economic data. Higher yielding corporate debt held up as earnings kept default risk relatively low.

Market Correlation

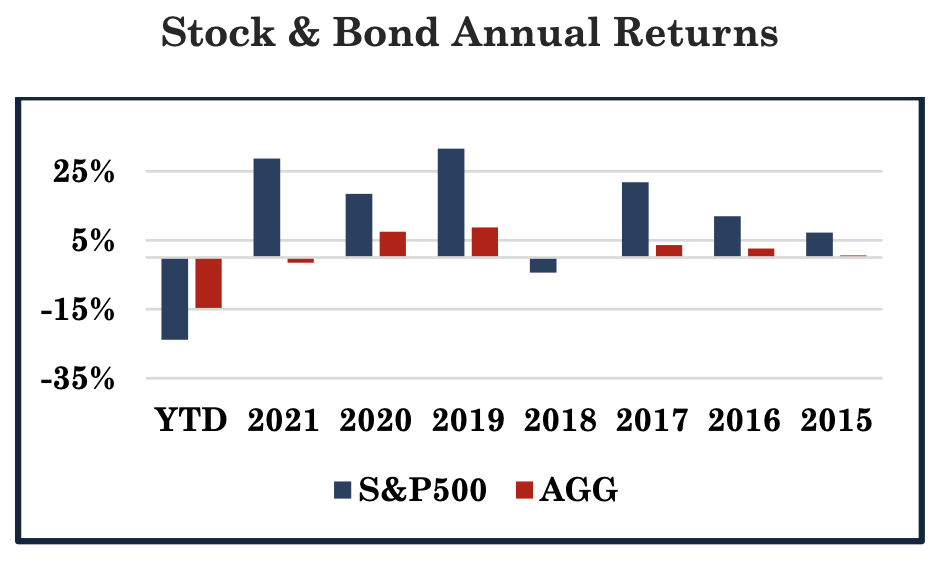

So far in 2022, both the stock and bond markets have posted severe losses. Currently, the S&P 500 is down over 20% year-to-date, and the bond market (represented by Bloomberg U.S. Aggregate Bond Index) has given up 16%. Should both indexes finish the year in negative territory, it would be the first time this has taken place in decades. Even though stocks and bonds can decline at the same time, history indicates it typically occurs within the perfect storm of fiscal/monetary/political disruptions.

Traditionally, the relationship between stock and bond returns has been a fundamental force in determining risk and setting portfolio asset allocation. For the past two decades the stock/bond correlation has been consistently negative, with bond investments providing a level of protection/reducing volatility to balanced portfolios when equity markets turn negative. While quarterly returns with both stock and bond returns in negative territory are not that unusual, in looking at annual returns, there have only been two calendar years where stocks and bonds were both down (1931 & 1969) *. But this year has been anything but typical in terms of market movements and asset correlations.

As seasoned investors, we expect stocks and bonds to react differently to economic data and metrics, as equities prefer growth environments while bonds prefer the opposite. Equities typically respond favorably to expectations for economic growth. Initially, future cash flows, expanding profit margins and potential dividend increases translate to higher stock prices. For fixed income assets, economic growth leads to inflation, pushing yields higher, reducing the value of cash flows, resulting in lower bond prices. However, if expansion is too rapid, and spurs inflationary pressures (September 2022 CPI was 8.2% year over year), wage pressures increase, interest rates move higher, negatively impacting borrow costs, cutting into profit margins and stock prices retreat. So, while economic growth lends to opposite reactions from stock and bond markets, inflation tends to cause similar outcomes with negative returns in both asset classes. It is no wonder that with all the markets have had to digest, that asset prices and returns have had such a dramatic downturn. Investors have enjoyed 10+ years of exceptional growth. Bond yields have been suppressed (one could argue artificially so), so it may not be the absolute level of yields, but here too, the rate of increase as markets forecast expectations.

It is important to remember that various asset classes attempt to accomplish specific goals for a portfolio over time and current positive stock/bond correlations should be viewed as short term. Because of this, appropriate allocation of asset classes should exist during all interest rate and market environments. When focusing on longer term goals and objectives, the appropriate growth asset and protective asset mix should be maintained regardless of where interest rates are or if one is more in favor versus the other at a particular point in time.

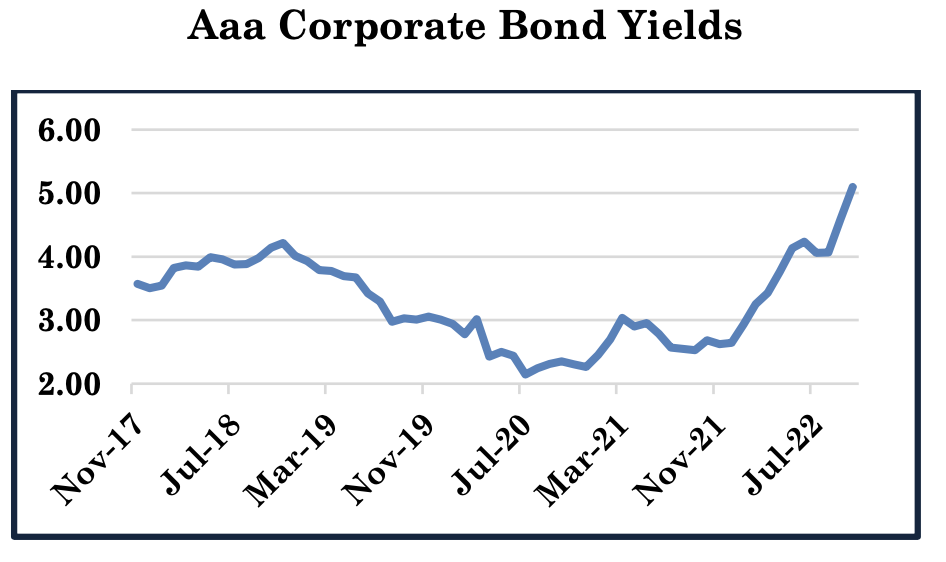

Although volatility still exists and returns have suffered, the positive is that bond yields have risen to levels not seen in decades. For investors whose primary objective is income and have money to invest in individual bonds, now could be an opportune time to lock in some higher yields.

Our emphasis remains on high quality taxable and municipal bonds, which typically reduces volatility. Building a bond ladder, distributes cash flows and maturities over a range of time, allowing for reinvestment risk to be managed, similarly to managing credit and issuer risk.

Rate increases have also provided for the opportunity to harvest losses for tax purposes where appropriate (consult a tax professional prior to making any trades).

At some point, history tell us, as unemployment rises and the economy weakens, inflation will come under control. Looking back to the mid 1960’s, the Fed was forced to raise interest rates to dampen demand, reacting to some of the same forces taking place today.

The U.S. economy slipped into a recession and both stock and bond returns recorded negative results. Once the Fed determines the rate hike cycle can be concluded, both stock and bond markets typically begin to move higher.

It is unclear whether the U.S. will slide into a recession or is already in one, but many experts believe much of the deterioration is behind us, representing an opportunity for investors. One recent Fed speaker noted that tighter monetary policy has begun to cool consumer demand and reduce inflationary pressures but added that the Fed’s job is not done. It appears that we’ll need to see quite a bit more evidence of an economic slowdown, particularly in the employment sector, before the Fed pivots toward a more dovish stance. As always, remaining patient, maintaining a consistent, well diversified, long-term objective has proved to be the optimal strategy.

Brian T. Moore Elizabeth D. Swartz November 2022

References

1. S&P 500 Third Quarter Performance Federal Reserve Economic Data.

2. Fed Funds Rate Federal Reserve Economic Data.

3. Growth vs Value YTD Performance FTSE Russell Indexes: Percentage change.

4. Stock & Bond Annual Returns

Federal Reserve Economic Data, Morningstar: Annual total return.

5. Aaa Corporate Bond Yields

Federal Reserve Economic Data: 10 year bond yield.

6. Financial Synergies

Disclaimer

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Chesapeake Wealth Management), or any non-investment related content, made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Chesapeake Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his or her individual situation, he or she is encouraged to consult with the professional advisor of his or her choosing. Chesapeake Wealth Management is neither a law firm nor a Certified Public Accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Chesapeake Financial Group, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.